Here are the eight things to ask a financial advisor to make an informed decision.

Key Takeaways

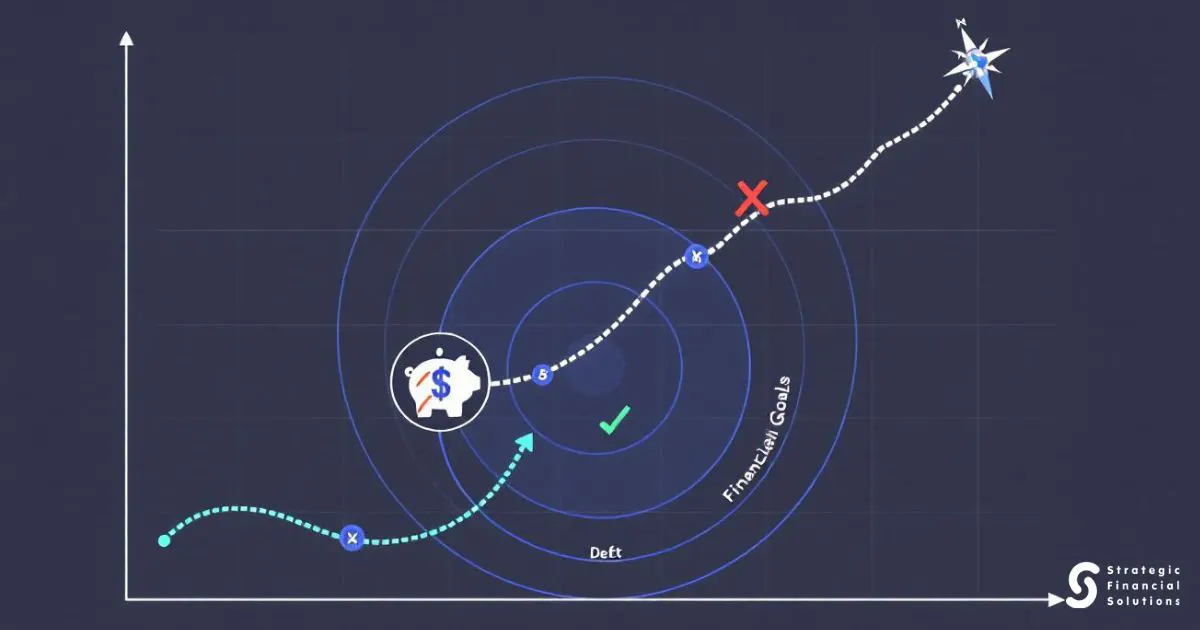

- Choosing a financial advisor involves evaluating their services, fee structures, and fiduciary duty to ensure alignment with your financial goals.

- A good advisor will tailor your financial plan to your individual circumstances and maintain communication to support you on your journey.

- Regularly reviewing success metrics and planning for unexpected events like incapacity means your financial strategies will adapt and protect you.

What Services Do You Provide?

Evaluating a financial advisor’s services helps determine if they can meet your needs.

They offer a wide range of services, including investing, tax planning, estate planning, debt management, and Australian financial services. These services form the foundation of most financial plans and contribute to overall financial well-being.

Beyond these core services, many firms also provide specialised services like business planning, cash flow management, and identifying growth opportunities. These offerings can benefit business owners or individuals with complex financial situations.

Advisors also provide guidance on education savings plans, insurance policies, and ongoing monitoring to adapt to changing circumstances.

Typical clients often require a combination of investment management, retirement planning, wealth management, tax advice, and estate planning.

For instance, retirement planning involves calculating future expenses and creating a savings plan to ensure a comfortable retirement. Understanding what services an advisor offers helps you find one that aligns with your goals and needs.

How Are Your Fees Structured?

Knowing how financial advisors charge for their services is important to avoid any surprises and make sure their fees fit your budget. Advisors may use various fee structures, including flat fees, hourly rates, asset-based fees and commissions. Each has its pros and cons, and the right one for you depends on your financial situation and the complexity of the services required.

Disclosing fees isn’t just a best practice, it’s a legal requirement. Transparency enables clients to comprehend the costs and, if necessary, negotiate fee structures. For instance, a flat fee might be ideal for straightforward financial tasks, whereas asset-based fees could be more suitable for ongoing investment management.

Also, consider the ongoing costs of long-term advisor relationships. Some advisors may charge extra for services outside the initial scope. Knowing these costs upfront will help you budget and avoid surprises.

What Is Your Investment Philosophy?

A financial adviser’s investment strategy is a glimpse into how they see your financial future. This should match your goals and risk profile. For example, some advisors may focus on growth strategies while others may be more defensive.

How comfortable are you with investment risk? A good financial advisor will tailor their strategies to ensure you feel at ease with your investment decisions. They should clearly explain how they balance growth and defensive needs in your investment portfolio.

Investment goals significantly influence a financial advisor’s approach. Whether you’re saving for retirement, planning a child’s education, or building wealth, the advisor should develop a tailored strategy to meet those specific goals.

By aligning their investment philosophy with your objectives, financial advisors can guide you through the complexities of the financial markets and help you make informed decisions.

Do You Have a Fiduciary Duty to Me?

One of the key things to consider when choosing a financial advisor is their fiduciary duty.

A fiduciary duty means the advisor is legally and ethically bound to act in your best interest. This means they put your interests ahead of their own.

Fiduciaries are required to avoid conflicts of interest and cannot accept undisclosed payments. This ensures that the advisor’s recommendations are genuinely in your best interests. Additionally, suppose an advisor cannot offer a suitable product from their approved list. In that case, they must seek alternatives that align with your best interests.

Having an advisor with a fiduciary duty ensures better alignment with your goals and reduces the likelihood of conflicts of interest. This alignment is key to building trust and confidence that your advisor is genuinely committed to helping you achieve your financial goals.

What Qualifications and Experience Do You Have?

When choosing a financial advisor in Australia, consider their qualifications and experience. Look for certifications such as CFP (Certified Financial Planner) and FPA (Financial Planning Association) membership, which indicate adherence to professional standards and high expertise.

Additionally, ensure they hold an AFSL (Australian Financial Services Licence) or work under someone who does, as this is crucial for providing financial advice in Australia. For more information on these qualifications, you can visit the Australian Securities and Investments Commission (ASIC) website.

Experience is a crucial aspect to consider. Ideally, an advisor should have at least a decade of experience, indicating they’ve encountered various financial situations. It’s also important to review their track record and check for any past legal or regulatory issues, as a clean history is vital for building trust and credibility.

Furthermore, knowing if the advisor has previously worked with clients with similar financial needs can be beneficial. This familiarity can give you added confidence that they understand your situation and can provide personalized advice.

How Will You Customise My Financial Plan?

Effective financial planning requires personalization. A skilled financial advisor will tailor their guidance to fit your unique circumstances, including your personal goals and financial situation. This ensures that your financial plan specifically aligns with your needs and objectives.

In your initial meeting, bring detailed information about your income, expenses, assets, and debts. This will allow the advisor to develop a realistic and achievable financial plan based on a full picture of your situation.

They may also ask you to complete a risk assessment questionnaire to gauge your comfort with investment risk and personal financial advice. Refer to the financial services guide for more information.

Advisors will discuss your short and long-term goals to align their strategies with your needs before making any recommendations. They will fully document and explain your financial plan so you can see how each part contributes to your goals.

What Are Your Communication Practices?

Effective communication is essential for maintaining a successful relationship with your financial advisor. Advisors meet with clients digitally or in person on a regular basis to accommodate your needs, ensuring you stay informed and engaged with your financial plan at all times.

They leverage technology and personal account management platforms to provide transparent access to information. Typically, advisors schedule regular meetings at least twice yearly to review your situation and make necessary adjustments. They also remain available outside of these scheduled meetings to address urgent matters and answer pressing questions.

By understanding an advisor’s response time to emails and phone calls, you can gauge their availability and service level, which is crucial for establishing a strong working relationship.

How Do You Measure Success?

Understanding how a financial advisor measures success is essential for setting realistic expectations and grasping their approach. Advisors often use benchmarks to assess investment performance against market and sector trends. Common benchmarks include the S&P 500 and the Dow Jones Industrial Average.

Financial plans track success by comparing investments to these benchmarks, which are chosen based on your goals and risk tolerance. For instance, a conservative benchmark for short-term financial needs might focus on maintaining purchasing power against inflation.

Regularly review your financial plan, ideally annually, to accommodate major life changes or market movements. This ongoing review ensures your financial plan aligns with your evolving goals and circumstances.

What Happens If I Die or Become Incapacitated?

Planning for the unexpected is a crucial part of financial advising. Estate planning ensures that your assets are distributed according to your wishes after your death. This planning involves creating legal documents such as wills and trusts to manage your estate effectively.

An Enduring Power of Attorney allows a trusted person to manage your legal and financial matters if you become unable to do so. This document remains valid even if you lose mental capacity, ensuring continuous management of your affairs. You can revoke a Power of Attorney at any time, but it’s advisable to do so in writing to avoid disputes.

Legislation exists to protect you if an appointed attorney abuses their authority. Planning for scenarios of incapacity or death ensures that your financial and legal matters are handled according to your wishes, providing peace of mind for you and your loved ones.

Summary

When selecting a financial advisor, asking the right questions can make all the difference in achieving your financial goals. From understanding the range of services offered to ensuring your advisor acts in your best interest, these questions provide a solid foundation for a productive and trustworthy advisor-client relationship.

By taking the time to ask these essential questions, you’ll be better equipped to find an advisor who can guide you towards a secure and prosperous financial future.

Remember, your financial well-being is worth the effort, and the right advisor can make all the difference. Ultimately, knowing the things to ask a financial advisor will empower you to make informed decisions for your financial future.

Contact Strategic Financial Solutions to learn more abour our financial advisors!

Frequently Asked Questions

What types of services should I expect from a financial advisor?

How are financial advisor fees typically structured?

Financial advisor fees are typically structured as flat fees, hourly rates, asset-based fees, or commissions, so it’s crucial to understand these options and any potential ongoing costs to stay informed. By doing so, you’ll be better prepared to manage your financial journey without unexpected surprises!

Why is it important for a financial advisor to have a fiduciary duty?

It’s crucial for a financial advisor to have a fiduciary duty because it guarantees they are committed to acting in your best interest, providing peace of mind that their advice is truly beneficial for your financial goals. Choose wisely, and prioritize those who prioritize you!

How can I ensure a financial advisor's investment philosophy aligns with my goals?

To ensure a financial advisor’s investment philosophy aligns with your goals, directly ask them to elaborate on their approach and how it fits your financial aspirations and risk tolerance. A good advisor will customize their strategies to match your preferences, so trust your instincts when evaluating their response!

What should I consider when evaluating a financial advisor's qualifications and experience?

To effectively evaluate a financial advisor, prioritize those with certifications like CFP or CFA, a minimum of ten years of experience, and a clean regulatory record. Their experience with clients similar to your financial situation is crucial for tailored guidance.